Do Government Jobs Offer 401(k) Matching? Everything You Need to Know

Government Retirement Match Calculator

See how much your government retirement plan matches your contributions. Calculate your employer match for federal, state, or local government positions.

Quick Takeaways

- Most federal jobs don’t provide a traditional 401(k) match, but the Thrift Savings Plan (TSP) offers similar employer contributions for FERS employees.

- State and local governments may have their own matching programs, but they vary widely.

- Understanding contribution limits, vesting rules, and tax advantages helps you make the most of any match.

- Compare private‑sector 401(k) matching with government plans to decide where you’ll get the best retirement boost.

- Action steps: enroll early, hit the match, and review investment options annually.

Ever wondered if a stable government job also means a solid retirement match? You’re not alone. While private companies brag about "matching up to 5%" on your 401(k), the public sector has its own set of rules that can feel confusing. This guide breaks down exactly how government jobs stack up against a typical 401(k) match, what programs like the Thrift Savings Plan (TSP) actually do, and how you can cash in on every dollar the government is willing to put toward your future.

Understanding 401(k) Matching Basics

In the private world, a "401(k) match" is straightforward: an employer contributes a set percentage of your salary to your retirement account, usually matching a portion of your own contributions. For example, a 100% match on the first 3% of salary means if you put in $3,000, the employer adds another $3,000.

Key attributes of a typical 401(k) match include:

- Matching rate - how much the employer adds per employee dollar.

- Contribution limit - IRS caps the total amount you can defer each year ($22,500 in 2024, $30,000 if you’re 50+).

- Vesting schedule - the time you must stay employed before the employer’s money becomes fully yours.

- Tax treatment - pre‑tax contributions lower your current taxable income; Roth options grow tax‑free.

Now, let’s see how the government’s retirement landscape mirrors or diverges from this model.

How Government Retirement Plans Work

Federal employees fall mainly under two systems: the Federal Employees Retirement System (FERS is the retirement system for most civilian federal workers hired after 1983, combining a Pension, Social Security, and a savings component) and the older Civil Service Retirement System (CSRS is a defined‑benefit pension plan for federal employees hired before 1984). Both rely heavily on the Thrift Savings Plan (a retirement savings and investment vehicle for federal employees, modeled after the private‑sector 401(k) as the savings component.

The TSP offers two main types of contributions:

- Employee deferrals - you choose how much of your salary to set aside, up to the same IRS limits as a 401(k).

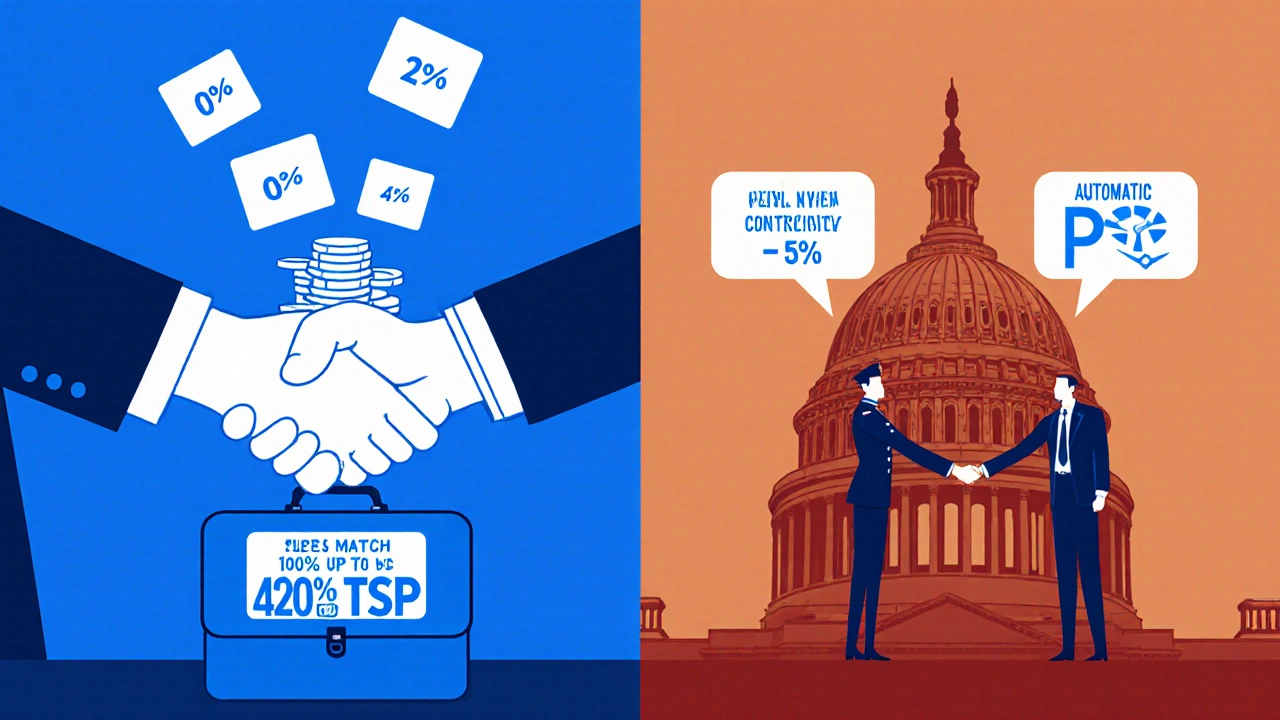

- Agency contributions - for FERS employees, the government automatically adds a fixed “automatic 1%” of your base pay, plus a matching contribution of up to 4% of your salary if you contribute at least 5% of your pay.

In other words, the government does provide a match, but it’s a little different:

- The base automatic 1% is non‑matching - you get it even if you don’t contribute.

- The matching portion is up to 4% of salary, not a dollar‑for‑dollar match but a tiered match similar to private‑sector formulas.

State and local governments often run their own plans, sometimes called "public‑sector 401(k) equivalents" or "457(b) plans," many of which include employer matching. However, the matching rates and eligibility rules can vary dramatically from one municipality to another.

Do Government Employers Offer Matching? A Detailed Look

Here’s a quick rundown of the most common public‑sector scenarios:

- Federal civilian jobs (FERS): automatic 1% + up to 4% match when you contribute at least 5% of your salary.

- Federal civilian jobs (CSRS): no automatic or matching contributions to TSP; retirees rely on the defined‑benefit pension.

- Military (civilian): similar to FERS with the same 1% + 4% match structure.

- State and local governments: may offer 457(b) or 401(k) plans with matching, often ranging from 3% to 6% of salary, but participation rules differ.

- Education and public safety (K‑12 teachers, police, firefighters): many districts provide a 3% or 4% match on contributions, but you often need to contribute a minimum percentage to qualify.

Because each agency sets its own policy, the best way to know for sure is to check your Human Resources portal or talk to the benefits office.

Comparing Private 401(k) Matching vs. Government Plans

| Feature | Private‑Sector 401(k) Match | Federal (FERS) TSP Match | State/Local 457(b) or 401(k) |

|---|---|---|---|

| Employer contribution type | Dollar‑for‑dollar up to a set percentage | Automatic 1% (non‑matching) + up to 4% match | Varies - often 3‑6% match if employee contributes |

| Typical matching rate | 0%‑6% of salary (often 100% of first 3‑5%) | Up to 4% of salary (if employee contributes ≥5%) | Usually 2%‑5% of salary |

| Contribution limit (2024) | $22,500 ($30,000 if 50+) | Same IRS limits as 401(k) | Same IRS limits |

| Vesting schedule | Often immediate or 3‑5 years | Immediate for automatic 1%; matching funds vest after 5 years of service | Varies - many plans vest immediately |

| Tax treatment | Pre‑tax or Roth | Pre‑tax (Traditional TSP) or Roth TSP | Pre‑tax or Roth options available |

From the table you can see that the federal match isn’t a pure dollar‑for‑dollar deal, but the automatic 1% plus up to 4% match can still be a powerful boost-especially when you factor in the low‑cost investment options the TSP offers.

How to Maximize Your Savings in a Government Job

Even if the match looks modest, you can stretch every dollar with a few smart moves:

- Hit the match early: For FERS, contribute at least 5% of your pay right away. That unlocks the full 4% government match and the automatic 1%.

- Take advantage of low‑cost funds: The TSP’s G Fund, F Fund, C Fund, S Fund, and I Fund have some of the lowest expense ratios in the industry, meaning more of your money stays invested.

- Use the Roth TSP if you expect higher taxes later: Contributions are taxed now, but qualified withdrawals are tax‑free, which can be a big win if you anticipate higher tax rates in retirement.

- Check for additional state/local matches: Some jurisdictions layer a 2% or 3% match on top of the federal contribution. Opt in as soon as you’re eligible.

- Rebalance annually: Even the TSP’s simple funds benefit from a yearly review to keep your asset allocation aligned with your risk tolerance.

Don’t forget the Employee Retirement Income Security Act (a federal law that sets standards for private‑sector retirement plans, ensuring fiduciary responsibility and participant protections) doesn’t govern the TSP, but the same fiduciary principles apply. Your agency’s HR team is required to provide clear statements about matching formulas, so ask for the “benefits summary” if anything feels murky.

Common Pitfalls & FAQs

Even savvy employees stumble over a few gotchas. Here are the most frequent mistakes and how to avoid them:

- Assuming the match is automatic - You must enroll in the TSP and set your contribution level to qualify for the matching portion.

- Ignoring the vesting schedule - If you leave before five years of service, you could lose the matching contributions.

- Over‑contributing to the TSP and missing other benefits - Some agencies offer health‑savings accounts (HSAs) or flexible spending accounts (FSAs) that also provide tax benefits; balance your savings strategy.

- Choosing the wrong investment fund - The G Fund is safe but low‑return; the I Fund can be volatile. Align your choice with your time horizon.

Next Steps: Your Action Plan

Ready to make the most of a government job’s retirement perks? Follow this simple roadmap:

- Log into your agency’s HR portal and locate the TSP enrollment page.

- Set your contribution to at least 5% of base pay (or the local equivalent) to capture the full match.

- Choose the G Fund for stability and add a mix of the C and S Funds for growth.

- Review any state or local matching programs and opt in if you qualify.

- Mark your calendar for an annual review - adjust contributions, re‑balance funds, and verify vesting status.

By taking these steps, you’ll turn a modest government match into a sizable retirement nest egg, often with lower fees than many private‑sector plans.

Does a 401(k) match exist for federal employees?

Yes, but it works through the Thrift Savings Plan. FERS employees receive an automatic 1% contribution plus a matching contribution of up to 4% of salary if they contribute at least 5% of their pay.

Can state or local government workers get a match?

Many state and local agencies offer matching on their 457(b) or 401(k) plans, but the rate varies. Some match 3% of salary, others up to 6%. Check your agency’s benefits guide for exact details.

What happens to the match if I leave my government job early?

The automatic 1% is always yours, but matching contributions typically vest after five years of service. Leaving sooner could forfeit a portion of the match.

Are TSP investment options comparable to private‑sector 401(k) funds?

Yes. The TSP offers five core funds (G, F, C, S, and I) covering government securities, fixed income, and stock market indexes. They have some of the lowest expense ratios in the market.

Should I choose a Roth TSP or a Traditional TSP?

If you expect your tax rate to be higher in retirement, Roth is usually best because withdrawals are tax‑free. If you think you’ll be in a lower bracket, the Traditional (pre‑tax) option can lower your current taxes.